Where Can FP&A Career Path Take You?

The growing variety and complexity of tasks within the finance function has resulted in the creation of a discipline that is supposed to become a bridge between the finance and business to support decision-making process by leveraging data and technology. This relates to FP&A which stands for financial planning and analysis.

The emerging FP&A practice steps out of the shadow of other finance functions becoming a standalone entity which involves its own mission, goals, organization, processes, tools and skills. FP&A analyst, in turn, is a promising yet developing profession that can be interesting to graduates with finance, statistics, economics or business degrees as well as to finance professionals from adjacent disciplines.

This article discusses typical activities and key responsibilities of FP&A practitioners, the range of skills required to perform these tasks, common roles, career opportunities of FP&A professionals, and how FP&A is distinguished from other finance functions and disciplines.

Typical FP&A activities and responsibilities

Financial planning and analysis is one of the pillars of the modern finance function. Access to a sufficient level of detail and at the same time ability to see the big picture predetermine the main goal or even the mission of the FP&A function – to support and drive the right strategic decisions in the company. This is true in all possible economic situations: in times of growth FP&A participates in setting business objectives, analyzing options of growth, assessing market opportunities and risks, while in times of recession FP&A can contribute to corrective action plans, cost-cutting and other initiatives to preserve company’s financial health.

Familiar with data analysis and armed with powerful tools, FP&A teams start to play more visible roles in the organizations providing their leaders with actionable insights and recommendations on the best ways to achieve company’s objectives, thus, having the direct impact on their company’s results and success.

The FP&A function in various organizations can have different levels of maturity which defines the range of responsibilities of the FP&A practitioners. The list of typical FP&A activities usually includes planning, budgeting, forecasting, analysis, management reporting and performance management.

Planning relates to determining the company’s short-term (1-year) and long-term (3-5 years) objectives. This process usually presumes the close collaboration of FP&A teams with business leaders and executives to align goals and expectations and create a common financial model of future revenues, costs and cash flows based on the external and internal factors and conditions.

Budgeting is a type of short-term planning whose goal is to transform strategic objectives into an operational plan by allocating available resources. This process usually occurs once a year and lasts several months.

Forecasting is the practice of making regular predictions about the company’s expected future results based on the past and present data as well as on the anticipated future events. The goal of forecasting is to enable organizations to better respond to changing conditions and drive business decisions with a sufficient level of confidence. This feature is an important advantage of a forecast over a budget which, on the contrary, is static and is rarely changed once approved.

Planning, budgeting and forecasting are linked together forming financial planning processes.

Financial analysis is a type of economic analysis based on the financial data and focused on the assessment of stability and evaluation of profitability of a company, business or project. Financial analysis is the cornerstone of the FP&A function enabling to provide recommendations and support informed business decisions.

Management reporting involves a set of reports submitted to management that aims at supporting decision-making process and monitoring progress.

Performance management is a range of practices which a company uses to measure its performance and communicate results. Linked with financial planning, analysis and reporting, business performance management becomes an inalienable part of the FP&A teams’ activities. FP&A analysts participate in the discussions of goals and key performance indicators (KPIs) to track the progress on the strategic and operational levels, make recommendations on how to improve performance.

To perform this variety of functions and tasks FP&A practitioners should possess and develop a certain set of hard and soft skills.

FP&A key skills

Top hard skills mentioned in almost every FP&A job opening include strong financial modeling and advanced spreadsheet skills. Financial planning (including scenario planning, what-if analysis) and reporting exercises are still performed in ubiquitous and beloved Excel, that is why it is really a must-have for FP&A analysts.

In the age of big data, familiarity with queries (SQL) can be very helpful for FP&A professionals to directly gather data and then analyze it to generate valuable insights.

At the same time, with the development of BI tools building dashboards and visualizations becomes a desired skill for FP&A professionals as it gives an opportunity to automate routine reporting and better communicate information and insights.

Turning to soft skills, it’s not so easy here. Of course, alike any finance profession FP&A requires a certain personality fit: numerical and analytical skills, attention to details as well as resilience to stress and ability to work under pressure are indispensable. These skills are essential as the better part of the day FP&A analysts spend working with large data sets, performing calculations, making conclusions, and all this is expected to be done within tough deadlines.

However, interpersonal and communication skills are equally important, especially today when we are witnessing a huge shift of the FP&A organization towards business partnership model. Networking on various levels, storytelling and clear communication of complex questions and calculations will contribute to building trust towards the FP&A team while business acumen and commercial awareness can be extremely helpful to find common ground with business departments.

The skill set of the FP&A professionals obviously evolve in time together with their roles and responsibilities in the FP&A team.

FP&A roles and career path

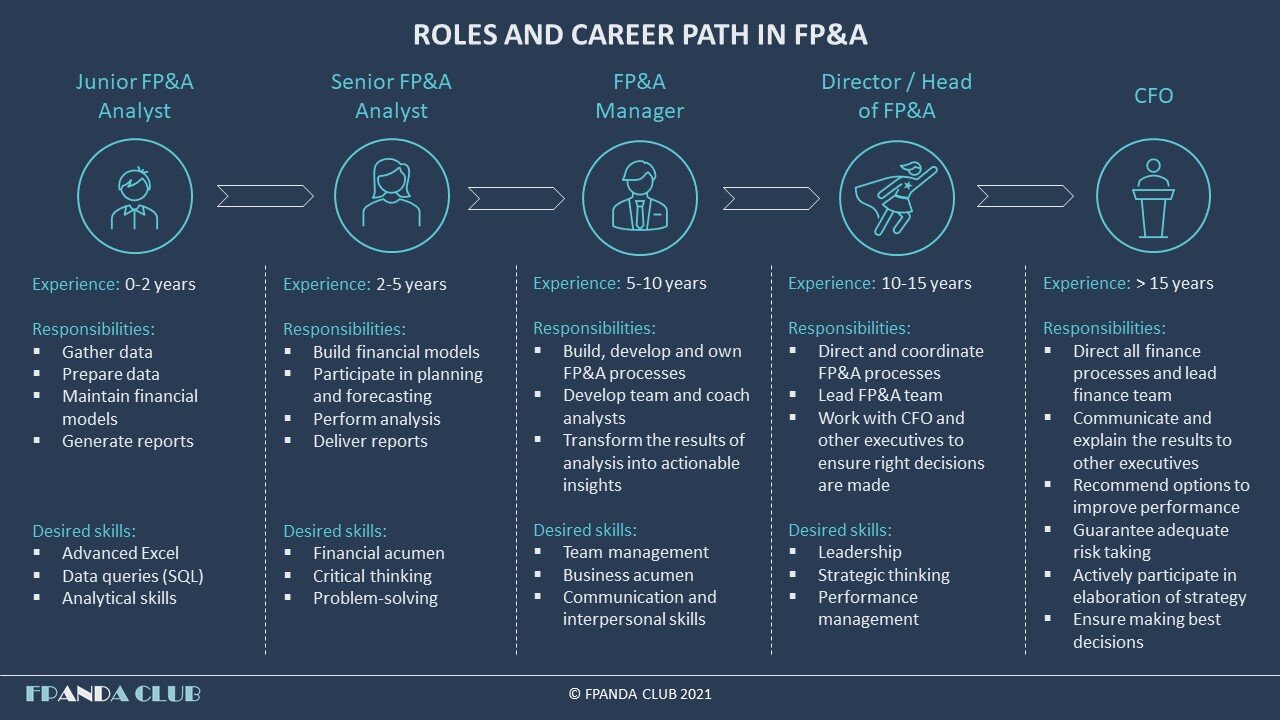

Though the organization of the FP&A function may vary depending on the company, the most common roles within FP&A teams are: junior FP&A analyst, senior FP&A analyst, FP&A manager and director/head of FP&A as it is represented in the picture below.

Junior FP&A analysts usually possess little or no relevant experience in financial planning and analysis. Their tasks mostly include data gathering and data preparation for further analysis performed by their senior colleagues to whom they directly report. Junior FP&A analysts are typically involved in basic recurring tasks, reports and projects so that they can hone their skills before moving to ad-hoc activities.

Senior FP&A analysts have solid experience in financial planning and analysis as well as overall understanding of the company’s financial performance. They can build complex financial models, analyze and interpret financial data, identify trends and make recommendations to improve results.

FP&A managers with significant relevant experience in FP&A are owners of FP&A processes which they build and improve according to needs and requirements. At the same time, they should be able to transform the results of their teams’ analysis into actionable insights and clearly communicate them. Possessing interpersonal and leadership skills they are capable of managing, coaching and developing their teams of junior and senior analysts.

FP&A directors supervise all aspects of the FP&A function in the company, communicate vision and provide leadership to the FP&A team. Being the CFO’s right hand, they work closely with business executives, deliver insights, actively participate in decision-making process and elaboration of strategy. FP&A directors can often boast of a considerable track record in financial planning and analysis, also they understand very well the finance function in general and the business model of the company, which leads them to the next step of their careers as Chief financial officer (CFO).

Another important aspect to consider within the discussed topic is how exactly FP&A is different from other finance disciplines, namely accounting, corporate finance and financial control.

FP&A vs accounting

While accounting and FP&A both work with numbers, financial statements, transactions and results, the main purposes of their functions are completely different. Accounting is usually focused on historical operations that have already been performed by the company in the past reporting period and, therefore, can be described as a reactive function. On the contrary, the responsibilities of the FP&A function include forecasting, planning and analysis to support decision-making which are future-oriented activities.

Both functions are essential in the organization as accounting is supposed to ensure accurate records and data which can be further analyzed by the FP&A team to generate valuable insights and support strategic and operational decisions.

FP&A vs financial controlling

Working closely with accounting function, financial controllers ensure compliance of reported results with accounting standards, legislation and regulations, develop and document policies and procedures of the internal control in the organization, participate in financial reporting, budgeting and forecasting. All this makes financial controllers obvious candidates for communicating with external auditors and managing the audit process.

Overall, the focus of the financial controller is to keep financial processes (including FP&A) organized and optimized, which contributes to their highly appreciated role in the company.

FP&A vs corporate finance

Corporate finance usually concerns a wide range of transactions and activities related to capital investment decisions, for example, mergers and acquisitions, raising capital, financing joint ventures, restructuring initiatives, IPOs. To support these operations from the financial standpoint corporate finance professionals:

Provide recommendations on sources of financing and business valuation,

Perform financial modeling of the outcomes, including potential returns and risks,

Participate in strategic planning,

Negotiate and structure financial deals,

Communicate with internal and external stakeholders.

Corporate finance activities are extremely important as they are directly linked to the company’s strategy and have a huge impact on the shareholder value. In large companies, frequently involved in this type of operations, internal dedicated corporate finance teams can perform these functions while in smaller companies FP&A teams or CFO consider corporate finance activities as part of their duties.

As we can see, FP&A professionals are involved in a wide range of activities to ensure informed decision-making and financial health of the organization, therefore, efficient FP&A function is essential for company’s business success. Along with traditional budget cycle exercises financial planning and analysis is constantly evolving, taking new responsibilities, building expertise in new fields and expanding the circle of communication and influence. Following this trend requires acquisition and development of new skills which become prerequisites of career advancements from entry-level to director’s positions.